Locations & Shared Branch Services

Don't see a fee-free ATM near you? Check out our Kasasa® checking accounts, which refund up to $25 per month in ATM fees.*

Shared Branching Locations

By checking the shared branches box above, you’ll see gray icons for just a few of our 5,600 credit union branches nationwide!

Mutual 1st Federal participates in Shared Branching, a network of credit unions that you can access for free, just as if you were at one of our locations. So next time you're not near a Mutual 1st Federal location, or are out of town, feel free to visit a Shared Branching location. Just enter the zip code of where your traveling in the box above to find a nearby location.

Please visit our F Street or Blondo branches for shared branching services. Our northwest Omaha branch is currently not a shared branching location.

At a Shared Branching location you can:

- Make deposits and withdrawals.

- Transfer funds between accounts.

- Make loan payments.

- Purchase money orders, travelers checks.

- Get official checks**.

- And much more.

When you enter a Shared Branching location, be sure to bring:

- Your home credit union's name.

- Your account number.

- Valid government-issued photo identification.

- If you are visiting a shared branch out of state, you will need to complete IDCheck and show the tellers your one-time passcode. Instructions for completing IDCheck are below!

Download the Shared Branching iPhone app or Android app or type in the zip code of where you are above to find locations near you.

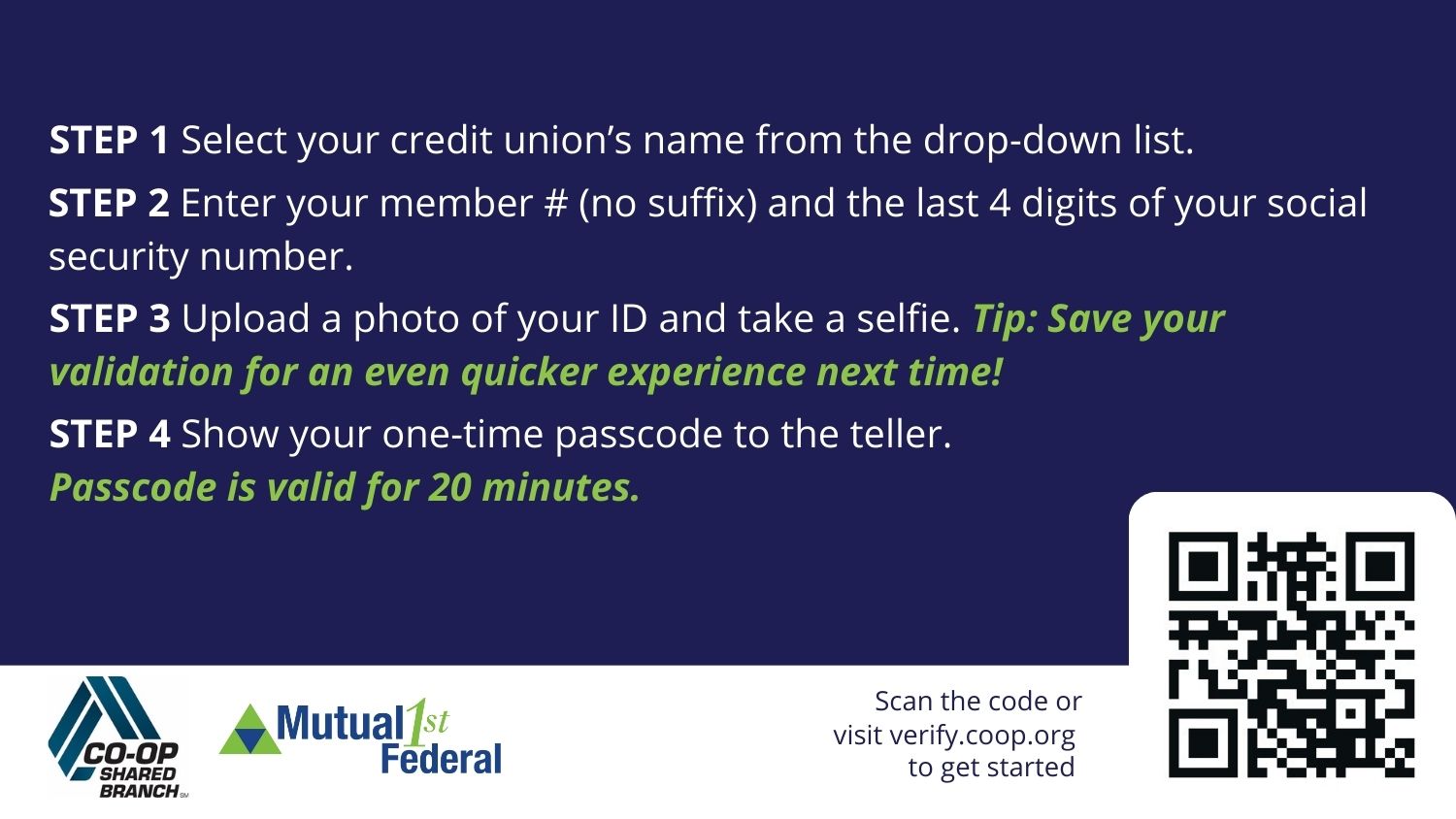

Shared Branching IDCheck Validation

To better protect you from identity theft, fraud, and financial loss, IDCheck verifies your identity in a few simple steps when you're utilizing shared branching services in a different state. This is a new and required security feature that has been implemented to help minimize fraudulent transactions through the shared branching network. If you're in another state, or your driver's license is from a different state than the shared branch you're visiting, you must provide this additional verification to process transactions. We are able to process withdrawals for $200 or less without IDCheck.

Once the IDCheck process is complete, you'll receive a one-time passcode to provide to the teller. They will enter it into the IDCheck program through Co-op, who manages the shared branch network, and confirm your identity. The one-time passcode is only good for 20 minutes. You can also save this verification so you don't have to repeat the entire process each time - you'll just need to generate a new passcode. No mobile device on you? No problem - our branches have an iPad you can use!

Please note, this verification is in addition to any other shared branching requirements already in place.

Visit verify.coop.org or scan the below QR code to get started, and take the following steps:

*All ATM fees generated by Automated Teller Machines located within the United States will be refunded (up to $25) when the qualifications are met each cycle. If they are not met, the ATM fee refunds will not be reimbursed for that cycle. Rates may change after the account is opened. Fees may reduce earnings. All qualification transactions must be posted and settled during the qualification cycle. Transactions could take more than 3 business days to post and clear an account from the date the transaction is made. An ACH transaction could either be a deposit or a withdrawal and are processed using our routing number and your account number. Limit one account per social security number; personal accounts only. Minimum to open account is $5.

**Shared branching checks may not be available at all outlets and locations.

Our Members, Their Stories

I love Mutual 1st Federal. I always feel like the employees care and that I'm getting a good deal.